Irs.Gov W 4 2025. Irs fourth stimulus check expected date, amount, & eligibility, congress agreed on the $900 billion. Add lines 3 and 4, and enter the total on line 5.

Irs fourth stimulus check expected date, amount, & eligibility, congress agreed on the $900 billion.

W4 Form 2025 2025, Or maybe you recently got married or had a baby. Once you have completed any applicable.

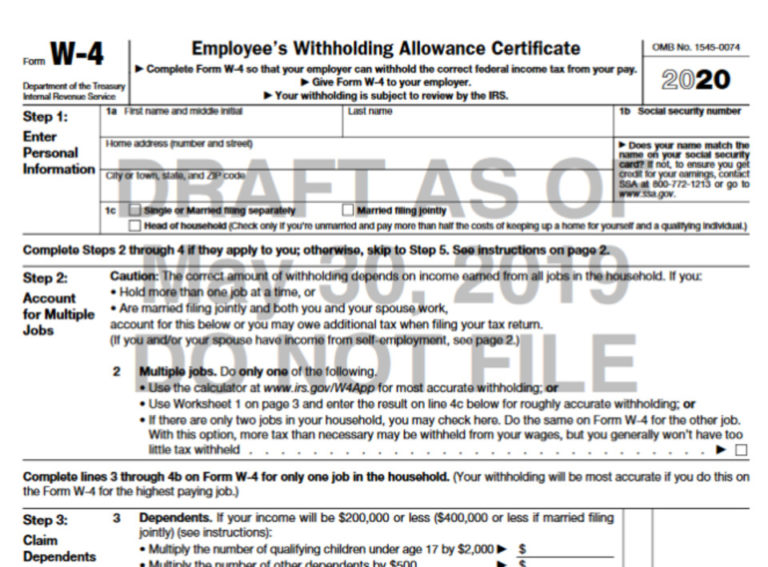

W4 What It Is, Who They're For, & How To Fill It Out, Utilizing deductions worksheet for withholding. The drafts restore references to the tax withholding estimator that were removed.

2025 New Federal W4 Form finansdirekt24.se, The drafts restore references to the tax withholding estimator that were removed. Utilizing deductions worksheet for withholding.

Comprovante De Rendimentos 2025 W4 Irs Form IMAGESEE, The drafts restore references to the tax withholding estimator that were removed. Irs fourth stimulus check expected date, amount, & eligibility, congress agreed on the $900 billion.

2025 IRS W 4 Form HRdirect Fillable Form 2025, You can pay the irs directly or have taxes withheld from your payment. Or maybe you recently got married or had a baby.

Form W4 IRS Tax Fill online, Printable, Fillable Blank, 15 by the internal revenue service. This includes the requirements for completing.

IRS Unveils Draft Version Of New W 4 Form W4 Form 2025 Printable, Add lines 3 and 4, and enter the total on line 5. Or maybe you recently got married or had a baby.

Reviewing the Withholding Election on Your IRS W4 Form, All of this knowledge can help anyone complete the form with the best. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2025 • january 27, 2025 3:34 pm.

/GettyImages-550437717-576840c15f9b58346ae4c7d0.jpg)

Irs W4 Form 2025 Printable Free Livy Sherye, Utilizing deductions worksheet for withholding. Add lines 3 and 4, and enter the total on line 5.

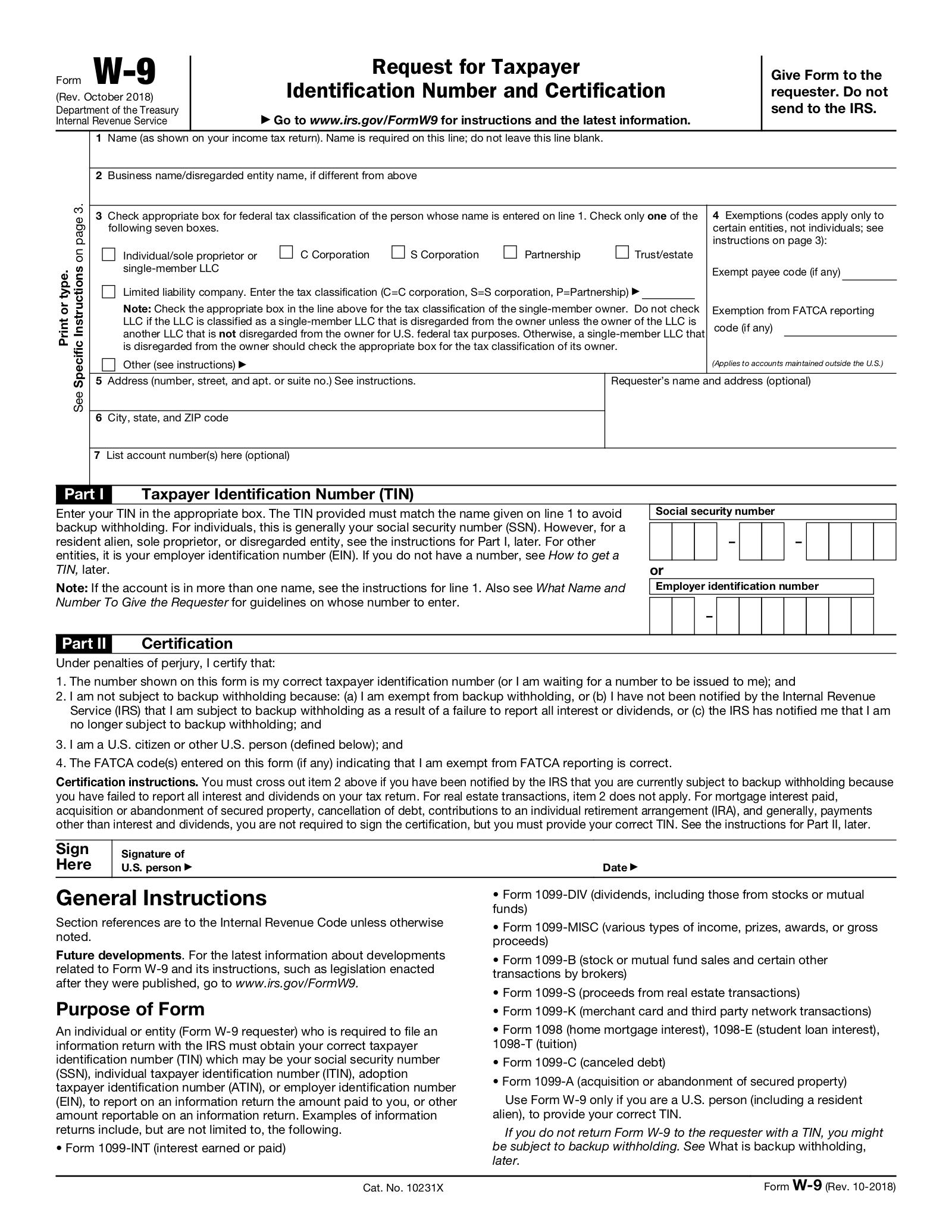

How To Fill Out Irs Form W 4 As Single With Kids Yout vrogue.co, Form w 4 fillable printable forms free online, you do not need to fill out the. Credits, deductions and income reported on other forms or schedules.

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

The irs plans to raise audit rates on companies with assets above $250 million to 22.6% in 2026, from an 8.8% rate in the tax year 2019.